Open Finance Association response to Payment Systems Regulator (PSR) Expanding variable recurring payments: Call for views (CP23/12)

Position Paper – February 2024

Introduction

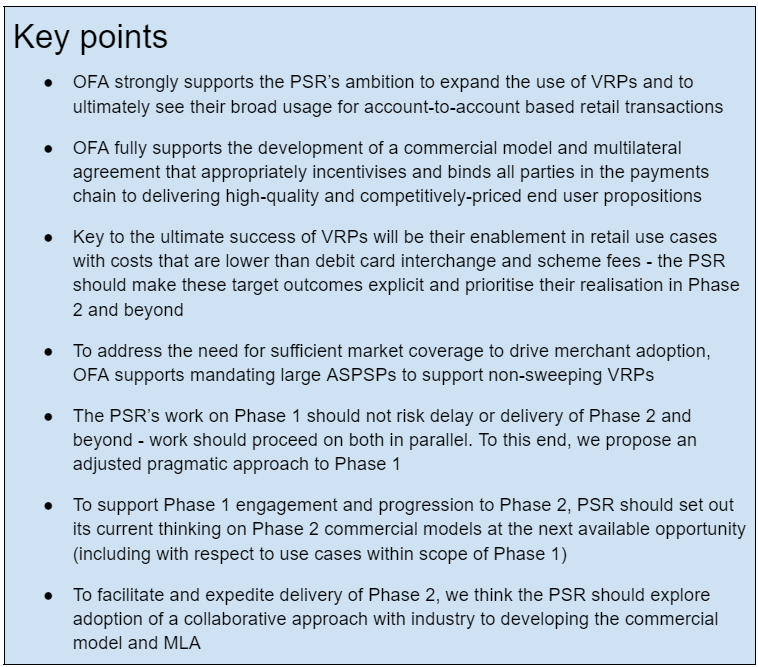

The OFA welcomes the PSR’s call for views on the expanding VRPs. We fully support the PSR’s ambition to expand the use of VRPs and to ultimately see their broad usage for account-to-account based retail transactions.

Before providing our views on the specifics of the PSR’s proposals, we set out our views on the expansion of VRPs more broadly.

A path to realising material end user benefits through VRP expansion

OFA members are at the centre of driving innovation and competition in open banking payments. Our members are already leveraging open banking functionality to deliver faster, more secure, and better value payment services to end users.

However, variable recurring payments for use outside sweeping remains a critical missing piece of open banking functionality. Once broadly available, non-sweeping VRPs will play a key role in enabling open banking to functionally compete on a level playing field with existing incumbent retail payment methods across a broad set of use cases.

In particular, OFA views that the largest potential and opportunity for end user benefit from non-sweeping VRPs lies in their use in retail payment scenarios where debit cards are currently the main form of payment acceptance. It is therefore critical that the PSR clearly identify this as an ultimate goal and work towards enabling VRPs in these scenarios as quickly as possible.

OFA believes that to ultimately realise this outcome, non-sweeping VRPs will need to be underpinned by a commercial model and multilateral agreement that appropriately incentivises and binds all parties in the payments chain to delivering high-quality and competitively-priced end user propositions (on both the consumer and merchant ends of the payment).

The majority view of OFA members is that, in practice, this means any steady-state commercial model for VRP needs to facilitate a fee paid by PISPs to sending ASPSPs to incentivise the development and ongoing support of compelling VRP consumer user experiences.

On the merchant side of the market, it is abundantly clear to OFA members that the overriding driver of interest from businesses in considering adoption of VRPs is reducing their cost of payments acceptance relative to that currently paid for cards. As a result, realising costs lower than debit card interchange and scheme fees should be adopted as a “north star” outcome that the PSR explicitly targets as its VRP work progresses.

There has now been a period of extended debate surrounding the potential expansion of VRPs outside sweeping. For both industry and regulators to maintain credibility and momentum behind VRPs, particularly in the merchant community, we think it is critical that real and tangible progress is realised in 2024. Seeing initial use cases of low risk non-sweeping VRP live before the end of year is therefore a key priority. Further, all members would welcome measurable progress towards development of an MLA and commercial model for a broad set of VRP use cases (including a target delivery date) – we view a collaborative approach between industry and regulator as being the best way of achieving this at pace.

Comments on the PSR’s proposals to begin expansion of VRPs

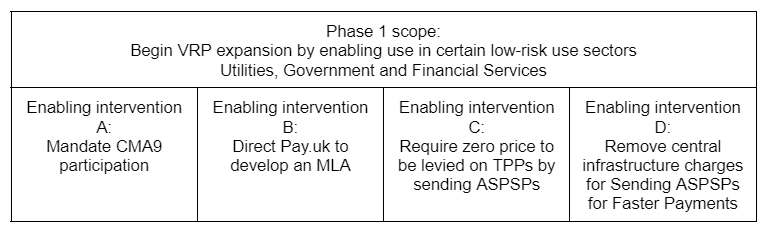

The PSR has proposed a phased approach to support the expansion of VRPs into non-sweeping use cases, and set out a number of potential policy interventions to underpin this approach:

We provide our comments against each element of the proposals below. Given the issues we outline regarding the current proposals, we then present a high-level proposal for a potential amended and pragmatic approach to Phase 1.

Phase 1 scope: Begin VRP expansion by enabling use in low-risk sectors – Utilities, Government and Financial Services

As a general observation, the primary existing method of payment acceptance in the identified low risk sectors is direct debit. While VRPs are able to function as an alternative to direct debit, our view is that the potential realisable end user benefit from migrating from direct debit to VRP is orders of magnitude lower than that possible for use cases where there is migration from card payments.

Given this, there is a universal desire from OFA members for any approach to Phase 1 to not distract or risk delay to the development of a Phase 2 commercial model/MLA. The potential for material end user benefits predominantly lies in use cases outside the Phase 1 scope.

For most of our members, in practice this means that as pragmatic approach as possible should be taken to accelerating delivery of Phase 1. For these members, Phase 1 still has an important role to play in demonstrating market progress on VRPs and to start demonstrating their real-world usage outside sweeping use cases. An outline proposal for a potential approach is presented below (see section titled “A proposal for an amended and pragmatic approach to Phase 1”)

Enabling intervention A: Mandate CMA9 participation

We strongly agree that the PSR should mandate certain ASPSPs to participate in Phase 1. Given the current limited level of material proactive bank engagement in industry efforts to progress VRP, consideration of mandation for Phase 2 is also likely to be necessary.

There is a clear coordination failure in the market at present – With the exception of Natwest, banks have shown that they will not voluntarily develop the functionality of their open banking APIs voluntarily, even when offered commercial terms. Without mandating coverage, there will be gaps in provision, and VRP won’t be able to compete with other payment methods that have ubiquitous provision across banks.

However, we don’t believe the CMA9 grouping is the right approach – this is not about the CMA market investigation and the market has moved on significantly since that work. The PSR should instead look at Faster Payment market share data by bank (specifically, outbound Faster Payment share originating from consumer payment accounts).

We believe mandating at least the six largest UK ASPSPs (Barclays, HSBC, Lloyds, Nationwide, Natwest, Santander) would likely enable ~90% market coverage and should be the starting point for mandating coverage (for example, see current account market shares set out in Feb-23 HMT basic bank account report). This scale of coverage should support realisation of the appropriate ‘network effects’ and give comfort to merchants that a significant share of the market is covered.

Enabling intervention B: Direct Pay.uk to develop an MLA

OFA members have concerns over Pay.uk’s capacity and ability to deliver a phase 1 MLA in a timely manner. Reasons include:

- Pay.uk already have a number of major in-flight initiatives to deliver which will take priority over VRP, such as:

- Delivering the NPA (while currently on hold, work may resume in near future and delay is also likely to have knock-on resource requirements).

- Delivering APP fraud reimbursement model and enhanced data sharing.

- Maintaining service for FPS, Bacs etc.

- Maintaining the CoP service.

- Maintaining the Current Account Switch Service.

- Pay.UK does not have a track record of delivering things quickly or efficiently – the NPA for example, is years behind schedule.

- Pay.UK does not have an established track record of engaging with open banking stakeholders (bar some infrequent high level roundtables).

Members also have a general concern around the deliverability of an MLA that would see low risk use cases live in Q3, regardless of which entity is appointed to lead.

In our view, longer term, the OBL/the Future Entity are more suited to playing a central role in governing a steady-state VRP MLA and commercial model.

Under our proposal for an amended and pragmatic approach to Phase 1 (as set out below), there is no requirement for an MLA. A body would still be required to coordinate a managed roll out of limited low risk use cases – we think this role could be fulfilled by OBL(who completed the managed roll of out of sweeping VRPs) with not much more material/development/resource than they have today.

Enabling intervention C: Require zero price to be levied on TPPs by sending ASPSPs

There is agreement among OFA members that the extent of the proposed Phase 1 commercial model is not an appropriate steady-state model for VRPs. As set out in our introductory remarks, except for one member as footnoted above, OFA members generally see the need for any steady-state commercial model for VRP to facilitate a fee paid by PISPs to sending ASPSPs to incentivise the development and ongoing support of compelling VRP consumer user experiences.

In general, we think more thought is needed on approaches to pricing for a steady-state commercial model, including whether a regulator is best placed to lead on developing this.

We think it will be difficult to adopt a standard cost-based approach to price setting in this specific context. Banks providing current/payment accounts provide multiple services (ability to make/receive payments, overdrafts, savings, mortgages etc), and have multiple income streams (net interest income, fee revenue) and cost centres. There are complex issues around cost allocation and cross-subsidies that would need to be considered under such an approach. We believe a cost recovery model alone could lead to protracted arguments about what costs need to be recovered and levels of appropriate underlying assumptions (amortisation periods etc.).

There are a range of different possible approaches to price setting, in both regulatory and commercial contexts, and a fuller assessment of which approach(es) are most appropriate is still required.

We think it likely the most appropriate approach will employ a combination of approaches to deliver a range of credible potential prices, within which a final price can be triangulated. Potential approaches to complement a cost-based approach may include willingness-to-pay type approaches (a form of which – the merchant indifference test – was adopted in the Interchange Fee Regulation). We think an overriding consideration for the PSR should be ensuring any approach is supportive of delivering a costs lower than debit card interchange and scheme fees.

However, on the basis of pragmatically demonstrating timely market progress, to start demonstrating VRP as a proposition outside sweeping, and to avoid the need for an MLA for Phase 1, a majority of members support adoption of zero price for Phase 1 – as long as accompanied by a commitment for Phase 1 to be explicitly time bounded, and for upfront confirmation from PSR that the Phase 1 commercial model will not persist into perpetuity (this will be particularly important in managing expectations of merchants looking to participate in Phase 1).

Enabling intervention D: Remove central infrastructure charges for Sending ASPSPs for Faster Payments

We do not think amendments to the central infrastructure charging arrangements for Faster Payments is appropriate to support Phase 1 for the following reasons:

- currently, a single set of per-item/click fees is consistently charged across all types of Faster Payments. Removing charges for a subset of Faster Payments will thus represent a further change requirement and is likely to have a number of material impacts on technical and operational processes at Pay.uk. As outlined above, Pay.uk has a number of other material items in their delivery pipeline. As a result we query the deliverability of these changes to support a Q3 go-live timeframe for Phase 1;

- the PSR’s position is (rightly, in a majority of OFA member’ views) that the Phase 1 commercial model is not the correct long-term position and so any changes at the infrastructure level may not be consistent with a steady-state model; and

- sending banks currently already pay outgoing fees to Pay.uk on faster payments sent from their consumer accounts without receipt of any direct inbound fees (consumers are typically not charged for sending – or receiving – faster payments). (Most OFA members view sending ASPSP compensation is best addressed in steady-state by a fee payment from PISPs.

However, we do think there a number of related strategic issues that the PSR should look into to support wider adoption of VRPs:

- The central infrastructure costs of sending and receiving Faster Payments remains expensive compared to international comparators. The total per-item/click infrastructure level fees for a Faster Payment (sending + receiving) are currently 1.9p; by comparison, in Europe, infrastructure fees for an SEPA instant payment cleared via RT1 and settled via TIPs costs 0.5p – so the infrastructure level costs of an instant payment in UK are over 3.6x in comparison. Driving these infrastructure level costs down will be an important part of facilitating broader use of VRPs for retail payments, particularly at lower transaction values.

- The costs levied by receiving banks on merchants to receive incoming Faster Payments into business bank accounts can be significant and also materially impact the economics of a merchant looking to accept VRPs. Given this, the PSR should look into receiving ASPSP’s charging practices to businesses for inbound Faster Payments. Further, we (with the exception of one member) disagree with recent comments from Chris Hemsley that changes to costs at the receiving end through business bank accounts may be the right way to approach the longer term commercial model for VRP.

A proposal for an amended and pragmatic approach to Phase 1

A majority of OFA members recognise that the PSR’s proposed ‘phase 1’ is an important and pragmatic starting point to begin expansion of VRP usage. These members are keen for it to be delivered without delay.

A multilateral agreement (MLA) is key to coordinating and clarifying the necessary elements in the long-term development of Phase 2 use cases (including e-commerce). However, we recommend delay of implementing an MLA until after Phase 1.

The majority of OFA members believe that phase 1 should be time limited, in respect of the pricing and MLA, and enabled through the same framework as sweeping has today – i.e. open APIs with no contracts. We don’t believe phase 1 should be dependent on an the development of an MLA because:

- The key goal should be to have low risk non-sweeping VRP low risk cases live in 2024.

- Developing a full MLA by Q3 2024 is very ambitious and there is a real risk of delay:

- The shared rulebook at the heart of the MLA will take months to agree and finalise, discussions facilitated by UK Finance to develop model clauses have already shown this to be a complex task, which is already delayed.

- Systems will need to be updated to differentiate between commercial and free PSD2 API calls/ faster payments.

- Billing mechanisms will also need to be built individually by each bank participant, and integrated by each TPP.

- The intention of an MLA was to manage issues such as disputes – but, as the PSR notes in its consultation – phase 1 use cases are low risk and disputes are unlikely. These could be mitigated through commitment to a code of conduct or similar softer mechanism by participants, drawing on the work being done on model VRP clauses by a UK Finance-convened group of banks and TPPs.

- If the price is set at zero, no contracts are practically required.

- OBL could be given responsibility for managing, what is essentially a repeat of the sweeping VRP managed roll out they have already undertaken, but for broader set of use cases.

This approach would allow industry to focus over the coming months on developing the MLA for phase 2. During this time, the PSR should work with industry on development of an MLA and approach to pricing for Phase 2 and beyond.

Approach to Phase 2 and beyond

To facilitate and expedite delivery of Phase 2, we think the PSR should explore adoption of a collaborative approach with industry to developing the commercial model and MLA. Under such an approach, we would propose:

- the PSR would set out the outcomes it expects the process to deliver (for example, realising costs lower than debit card interchange and scheme fees) and by when (e.g. Q4 2025 per December JROC publication), providing final decisions on contentious issues, supporting with management of competition law risks, and maintaining a credible threat of intervention should progress stall.

- Industry would be tasked to develop the specifics of the MLA and commercial model (likely involving engagement of independent third-party subject matter experts with close regulator oversight to ensure this is not unduly delayed or cost prohibitive).

Work on such an approach should begin immediately and run in parallel with Phase 1.

CONTACT

Join us and be the voice of Open Finance in the EU and UK.

Copyright OFA 2022